Filling the gap in the African Trades

We support

Commodity flows

The Sub-Saharan

Africa specialist

Discover the benefits of working with us

About Us

“Head-quartered in Switzerland, TFC is a private trade service provider specialised

in the vibrant markets of Sub-Saharan Africa”.

Specialists in commodity-backed trade finance

We finance commodity trades, secured by the underlying transaction or inventory positions.

Singular risk management and supply chain capabilities

Supported by preferential risk management agreements with regional leading supply chain and logistics providers.

A dedicated team of professionals

Our team combines decades of multi-disciplinary experience in the African commodity sector, structured trade finance, supply chain and risk management.

Business oriented processes

Our on-boarding procedure is transaction, rather than balance sheet focused. Our bespoke solutions are designed to enhance the businesses of producers, exporters, traders and importers across a wide range of commodities and raw materials.

Business philosophy

Long-term partnership, commitment and trust are our key values; each long-standing customer is a partner whom the firm is ready to invest on.

We support Commodity flows

by providing liquidity, logistics, and risk mitigation solutions

Solutions for Exporters and Importers

We support a wide range of commodities and raw materials that are extracted, grown or processed in Africa,

or imported into the continent for local distribution and industrial consumption.

A vibrant environment

Our customers range from seasoned exporters of goods originated in the mineral rich provinces or the fertile highlands…

…to specialised importers of fertiliser, construction materials or chemicals looking for inventory and distribution financing.

- Metals

- Agricultural

- Chemicals & Fertilisers

- Others

Our trade services solutions

Liquidity, logistics, risk mitigation.

Liquidity

Most popular solution among traditional financial institutions. It relies on standardized rules and is often supported by risk mitigation instruments such as letters of credit and price hedging...

Logistics

Since each client has individual needs and each transaction is unique, the finance facilities are structured to match the customer’s transactional specificities.

Risk mitigation

Working capital facilities based on the value of in-transit or in-stock inventories which are used as collateral.

Criteria

Goods flow in/out of sub-Saharan countries

Goods under control of one of our logistics partners

The funding facility is self-liquidating

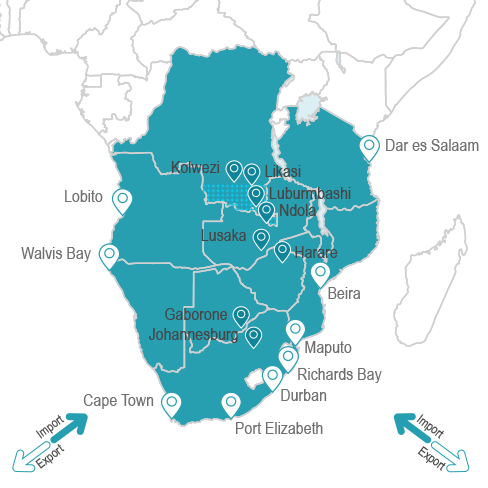

The Sub-Saharan Africa Specialists

Our business model is driven by local partnerships with leading supply-chain providers.

TFC places at the service of the trade a dense network of local warehouses, transporters, clearing agents and freight forwarders in order to manage the operational risks and guarantee the goods backing the finance facility.

This particular setup allows the company to finance and monitor goods in transit or in stock in all the major import and exports corridors.

Sub-Saharan Africa truly is our comfort zone, where others back-off TFC is able to structure secured and competitively-priced financial solutions.

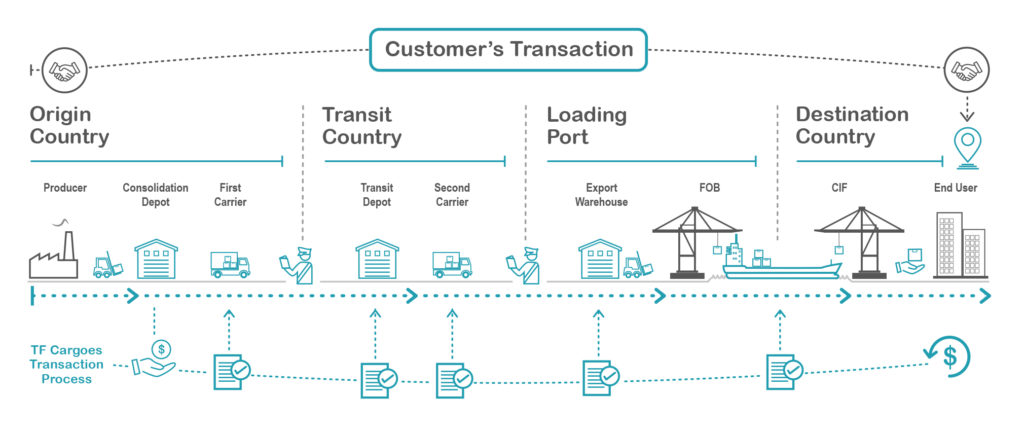

Flow Scheme

TF Cargoes adopts a unique approach to REPO financing by combining risk management and trade finance. The end result is less bureaucracy and improved efficiency for all the trade parties involved.

With the purpose of structuring the finance and mitigating the risks involved across the logistic chain TF Cargoes steps into the customer’s supply processes on principal capacity. No matter how complex the logistics set-up is, TF Cargoes will take delivery of the goods at the point where the finance is required and deliver back where the customer needs them.

Easy on-boarding

The route to the first transaction in 5 phases

Here are some other advantages of working with TF Cargoes:

1

Presentation

After signature of an NDA and during an exploratory discussion you will explain to us what the business is about and what the transaction specialties are. We will provide you with preliminary advice, indicating what is the best product to cover your needs.

2

Compliance

If you are eligible for our trade finance service and our solutions are of interest, a KYC and Due Diligence process will be completed

3

STRUCTURISATION

Having cleared the compliance phase, you will receive a tailor-made financing proposal with a term sheet describing the terms and conditions of the service.

4

Contracts

Upon agreement on the terms we will draft and provide you with the Facility Agreement and the contracts.

5

First Transaction

Once the contractual and security package is signed we are ready for the first transaction.

1

Presentation

After signature of an NDA and during an exploratory discussion you will explain to us what the business is about and what the transaction specialties are. We will provide you with preliminary advice, indicating what is the best product to cover your needs.

2

Compliance

If you are eligible for our trade finance service and our solutions are of interest, a KYC and Due Diligence process will be completed

3

STRUCTURISATION

Having cleared the compliance phase, you will receive a tailor-made financing proposal with a term sheet describing the terms and conditions of the service.

4

Contracts

Upon agreement on the terms we will draft and provide you with the Facility Agreement and the contracts.

5

First Transaction

Once the contractual and security package is signed we are ready for the first transaction.

Our transaction principles & criteria

In a nutshell, this is what TF Cargoes offers:

- We finance profitable trades whereby the client can afford the facility fees.

- We give preference to long-term and self-liquidating transactions.

- The facility is used to execute the purchase and sale, transportation and storage of the goods.

- The goods are to be placed under control of acceptable logistics and supply chain providers.

- Depending on the case and as part of our risk management principles, we get involved in aspects of the trade such as physical inspection and quality control.

From the Grapevine

What People Say

Get In Touch

Contact Details

TF Cargoes is a trade finance and supply chain management solution for commodity traders with liquidity requirements in Sub-Saharan Africa

Rue De La Cité 1, 1204 Geneva, Switzerland

contact us

Drop Us a Line

Let's stay in touch

Subscribe to our newsletter and get exclusive deals you wont find anywhere else straight to your inbox!