填补非洲贸易融资领域的空白。

我们为大宗商品提供融资服务。

撒哈拉以南非洲融资专家。

了解一下与我们合作的优势。

关于我们

“TFC是一家总部位于瑞士的私人融资公司,专注于撒哈拉以南非洲欣欣向荣的市场”。

关于我们

“TFC是一家总部位于瑞士的私人融资公司,专注于撒哈拉以南非洲欣欣向荣的市场”。

大宗商品贸易融资专家

我们以基础交易或库存水平做担保,为大宗商品交易提供融资服务。

单一风险管理及供应链能力

我们同区域内一流的供应链及物流供应商签订有优先风险管理协议,为我们的业务提供支撑。

专业化团队

我们的团队整合了数十年的多学科行业经验,涉及的领域包括非洲大宗商品、结构化贸易融资、供应链以及风险管理等。

面向业务的工作流程

我们的工作进程是为了交易, 我们的定制解决方案旨在加强生产商、出口商、贸易商和进口商在各种商品及原材料方面的业务。

经营理念

我们秉承的主要价值观是长期合作、彼此承诺以及相互信任;每一位长期客户都是公司准备投资的合作伙伴。

大宗商品贸易融资专家

我们以基础交易或库存水平做担保,为大宗商品交易提供融资服务。

单一风险管理及供应链能力

我们同区域内一流的供应链及物流供应商签订有优先风险管理协议,为我们的业务提供支撑。

专业化团队

我们的团队整合了数十年的多学科行业经验,涉及的领域包括非洲大宗商品、结构化贸易融资、供应链以及风险管理等。

面向业务的工作流程

我们的工作进程是为了交易, 我们的定制解决方案旨在加强生产商、出口商、贸易商和进口商在各种商品及原材料方面的业务。

经营理念

我们秉承的主要价值观是长期合作、彼此承诺以及相互信任;每一位长期客户都是公司准备投资的合作伙伴。

我们为大宗商品提供融资服务

进出口商解决方案

我们的融资机制适用于各类商品及原材料。它们或者在非洲本地 选取、种植、加工, 或者经进口到达非洲后供当地分销及工业消耗。

欣欣向荣的环境

我们的客户群体极为广泛:涵盖了来自矿产丰富省份或肥沃高原的经验丰富的商品出口商以及寻求库存和分销融资的肥料、建筑材料或化学品专业进口商等等各类商家。

- 金属

- 农业

- 化学品及肥料

- 化学品及肥料

我们为大宗商品提供融资服务

进出口商解决方案

我们的融资机制适用于各类商品及原材料。它们或者在非洲本地 选取、种植、加工, 或者经进口到达非洲后供当地分销及工业消耗。

欣欣向荣的环境

我们的客户群体极为广泛:涵盖了来自矿产丰富省份或肥沃高原的经验丰富的商品出口商以及寻求库存和分销融资的肥料、建筑材料或化学品专业进口商等等各类商家。

- 金属

- 农业

- 化学品及肥料

- 化学品及肥料

我们的融资解决方案

灵活的大宗商品贸易融资服务。

交易性贸易融资

此类贸易融资是传统金融机构中最受欢迎的解决方案。此类贸易融资是传统金融机构中最受欢迎的解决方案。

结构性贸易融资

由于每一位客户都有其自身的独特需求,且每笔交易均具有其独特性,因此融资机制的结构应与客户的交易特点相匹配。

借款担保基础的贷款融通

营运资本融通以用作抵押品的在途或库存存货价值为基础。

标准

商品流入/流出撒哈拉以南国家

商品受我们其中一个物流合作伙伴控制

融资安排具有自偿性

我们的融资解决方案

灵活的大宗商品贸易融资服务。

交易性贸易融资

此类贸易融资是传统金融机构中最受欢迎的解决方案。此类贸易融资是传统金融机构中最受欢迎的解决方案。

结构性贸易融资

由于每一位客户都有其自身的独特需求,且每笔交易均具有其独特性,因此融资机制的结构应与客户的交易特点相匹配。

借款担保基础的贷款融通

营运资本融通以用作抵押品的在途或库存存货价值为基础。

标准

商品流入/流出撒哈拉以南国家

商品受我们其中一个物流合作伙伴控制

融资安排具有自偿性

交易方案

TF Cargoes adopts a unique approach to REPO financing by combining risk management and trade finance. The end result is less bureaucracy and improved efficiency for all the trade parties involved.

With the purpose of structuring the finance and mitigating the risks involved across the logistic chain TF Cargoes steps into the customer’s supply processes on principal capacity. No matter how complex the logistics set-up is, TF Cargoes will take delivery of the goods at the point where the finance is required and deliver back where the customer needs them.

交易方案

TF Cargoes adopts a unique approach to REPO financing by combining risk management and trade finance. The end result is less bureaucracy and improved efficiency for all the trade parties involved.

With the purpose of structuring the finance and mitigating the risks involved across the logistic chain TF Cargoes steps into the customer’s supply processes on principal capacity. No matter how complex the logistics set-up is, TF Cargoes will take delivery of the goods at the point where the finance is required and deliver back where the customer needs them.

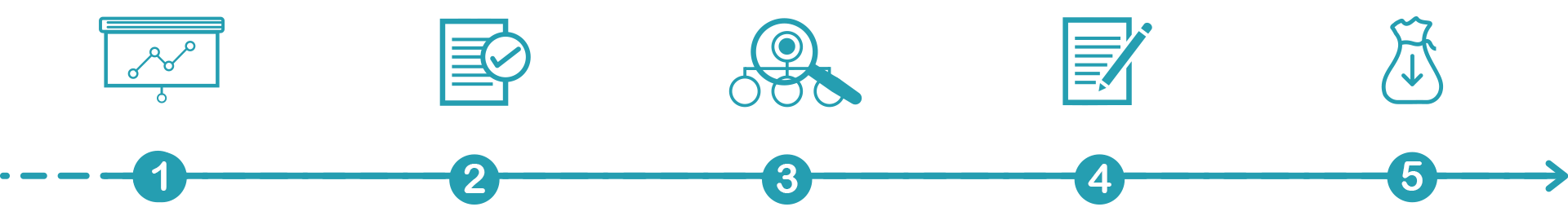

Easy on-boarding

The route to the first transaction in 5 phases

Here are some other advantages of working with TF Cargoes:

1

Presentation

After signature of an NDA and during an exploratory discussion you will explain to us what the business is about and what the transaction specialties are. We will provide you with preliminary advice, indicating what is the best product to cover your needs.

2

Compliance

If you are eligible for our trade finance service and our solutions are of interest, a KYC and Due Diligence process will be completed

3

STRUCTURISATION

Having cleared the compliance phase, you will receive a tailor-made financing proposal with a term sheet describing the terms and conditions of the service.

4

Contracts

Upon agreement on the terms we will draft and provide you with the Facility Agreement and the contracts.

5

First Transaction

Once the contractual and security package is signed we are ready for the first transaction.

1

Presentation

After signature of an NDA and during an exploratory discussion you will explain to us what the business is about and what the transaction specialties are. We will provide you with preliminary advice, indicating what is the best product to cover your needs.

2

Compliance

If you are eligible for our trade finance service and our solutions are of interest, a KYC and Due Diligence process will be completed

3

STRUCTURISATION

Having cleared the compliance phase, you will receive a tailor-made financing proposal with a term sheet describing the terms and conditions of the service.

4

Contracts

Upon agreement on the terms we will draft and provide you with the Facility Agreement and the contracts.

5

First Transaction

Once the contractual and security package is signed we are ready for the first transaction.

Our transaction principles & criteria

In a nutshell, this is what TF Cargoes offers:

- We finance profitable trades whereby the client can afford the facility fees.

- We give preference to long-term and self-liquidating transactions.

- The facility is used to execute the purchase and sale, transportation and storage of the goods.

- The goods are to be placed under control of acceptable logistics and supply chain providers.

- Depending on the case and as part of our risk management principles, we get involved in aspects of the trade such as physical inspection and quality control.

From the Grapevine

What People Say

Get In Touch

Contact Details

TF Cargoes is a trade finance and supply chain management solution for commodity traders with liquidity requirements in Sub-Saharan Africa

Rue De La Cité 1, 1204 Geneva, Switzerland

contact us

Drop Us a Line

Let's stay in touch

Subscribe to our newsletter and get exclusive deals you wont find anywhere else straight to your inbox!